|

Renting may seem like a straightforward process but there are several things to consider as you begin looking for a rental.

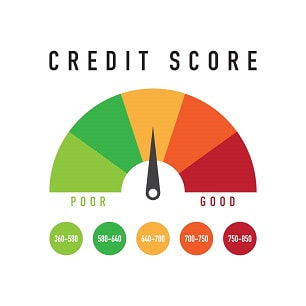

Preparing to Rent Begins Before You Start Looking for A Rental Property When thinking about our physical health we are often told we should consider following certain health measures to prevent future problems. Our financial health is similar. We need to consider preventive measures to help us meet future financial situations. The following are guidelines to help you improve your financial health, as it applies to your credit score. Know what your credit score is, primarily your FICO score There are a number of companies which have credit scoring formulas, but most lenders use what is known as your FICO score. FICO stands for the Fair Isaac Corporation, which was a pioneer in developing a method to calculate credit scores. These scores are based on information from various credit reporting agencies. There is no single FICO score. Your score depends on the information found in your credit reports generated by Experian, Equifax and Transunion. The FICO score from each of these agencies may vary depending on the data used to calculate the score. So, how do you find out what your FICO score is? Once a year you can get a copy of your credit report for free from annualcreditreport.com, however this does not give you your FICO score. Usually, you will need to pay a fee to receive your FICO score, although freecreditreport.com is supposed to give you both your credit report and FICO score completely free through Experian. You can also find your FICO score through your bank, credit union, or credit card company. As mentioned, these scores may vary slightly depending on the credit agency used., however the scores are usually fairly close. It cannot be emphasized enough the importance of learning what your FICO score is. A FICO score of 620 or less is not looked at in a positive way. It is important to work toward getting your FICO score in the 700s, or higher. However, the reason for a low score is also a consideration when renting. If you are just starting to establish credit, have a good employment record, and no bills in collections, it is different than having a low FICO score due to high credit card debt or bills in collections. Why is you FICO score important? Your credit score is used by lenders to determine the likelihood of having a loan paid off on time. It is used by property management companies to determine if you will pay your rent on time. If you have unpaid bills or a high debt to income ratio it creates doubt as to your ability to manage your money effectively. It does not appear that you take you financial health seriously. This may mean that your rental application will be denied or that you will be expected to pay a higher security deposit because of an owner’s concern that you might be more likely to default on your rental obligation. Many property management companies will consider more than just your credit score in making their decision. For instance, you may just be starting to build your credit history, you may have medical or school debt that has lowered your score. Medical and school loans do not have as great an impact as unpaid utility bills, unpaid rent, or other unpaid consumer bills. However, improving your FICO score will help you in all areas of your financial health so it is something you should work on. How to improve your FICO score First of all, get a copy of your free annual credit report.

1 Comment

Renting a property is more than filling out an application, paying the application fee, and then waiting to hear if you have been approved. There are certain steps that need to be taken to ensure that an owner would be willing to rent to you. The next few blogs will address these steps.

As I reflected on my experiences in helping people find a rental, I consider being up-front and honest about your situation to be of primary importance. I am not speaking of giving out confidential information, but simply letting your showing agent know if there are any background, credit, employment, or income problems. A real estate agent, or the property management company they are associated with, cannot magically produce a positive outcome if there are negative items that need to be resolved. Sometimes these issues can be taken care of right away, but often they are situations that should have been addressed before you started searching for a rental. A reliable showing agent can guide you in the direction you should go to resolve an issue that may lead to your application to be denied. This does not mean that all issues can be solved in a few days’ time. Some situations may require weeks, or months to take care of. If you are in this position, and need to move right away, it can be frustrating and cause a great deal of anxiety. (In a future blog we will discuss how to prevent this scenario from happening.) Be willing to listen to the advice you may be given, even if it is not what you want to hear. Most showing agents are willing to assist you. They want to help you navigate the rental process, but there are certain procedures and regulations that need to be met. If you do not follow your agent’s advice and there are discrepancies in your application, it will cause confusion on the part of the management company and the owner. When there is confusion, an application will usually be denied. It looks like you are trying to be deceptive. The adage “honesty is the best policy” is good advice. A showing agent cannot successfully help you if they do not have the correct information. You may not like their suggestions, however if you are receptive to you agent’s advice you can take the steps necessary to strengthen your chances of having a rental application approved. From McKenna Property Management website blog:

Every year the need to get more and more creative for Valentine’s Day grows, so a stuffed teddy bear and chocolate candies may not cut it this year. The relief though is that you live in Las Vegas, one of the most creative places in the United States! Knowing that sometimes Las Vegas natives forget to enjoy our own city, McKenna Property Management wants to suggest a great experience for Cupid's Day: The High Roller. It’s been around for a while, but some of our team members, even those born and raised in Las Vegas, have only been on it once, if at all! The High Roller is the perfect way to celebrate Valentine's Day. It is in a wonderful location on the Strip, offering bars, restaurants, and fountain light shows that match with the High Roller, and once you are off the LINQ Promenade you are just minutes away from the Colosseum and Bellagio which have amazing restaurant options. And the best part of all… It’s not going to break the bank. One admission for an adult during the day is $23.50 and the night is $34.75. With it being a 30-minute ride, you are definitely getting your money’s worth. Make sure when you go to schedule a reservation ahead of time to look at when the sun sets on the day you’re going, so you can get two amazing views for Valentine’s Day: the Vegas Skyline lit by the setting sun, and your date for the evening! To buy visit the Linq website here. Set goals you can actually accomplish We are a couple of months into the new year, 2021. Did you set resolutions for the coming year? How committed have you been to those resolutions or goals?

There are things we cannot control but setting goals is something that can help us accomplish what we desire within our sphere of influence. With this in mind, and with my broker Jenni McKenna’s permission, I would like to share a blog from the McKenna Property Management’s website. If you feel you have failed to keep your New Year’s resolutions or if you want ideas on how to make your goals more effective, I believe this information will be of great help. Enjoy, learn and apply. Every year when the clock strikes midnight people always promise to commit to their New Year resolutions. A fun pastime that inspires us to be a better person, and hopefully as a result make the new year better too. I have always been fascinated with this tradition and did some research. According to Forbes nearly 60% of Americans make New Year’s Resolutions. Unfortunately, only 25% of them commit up to thirty days and only 8% complete their goals. We here at McKenna Property Management love to set goals, so we want to give you our not-so-secret guide to goal and resolution success. It is called the SMART method and SMART stands for:

These five categories are a tried-and-true equation to accomplish goals, whether that be for work or personal life. First, to achieve your goals you need to be specific. Goals that are specific have a significantly greater chance of being accomplished. To make a goal specific, the five “W” questions must be considered:

For example, a general goal would be “I want to get in shape.” A more specific goal would be “I want to obtain a gym membership at my local community center and work out four days a week to be healthier.” Next, your goal must be measurable. If there are no criteria, you will not be able to determine your progress and if you are on track to reach your goal. To make a goal measurable, ask yourself:

For example, building on the specific goal above: I want to obtain a gym membership at my local community center and work out four days a week to be healthier. Every week, I will aim to lose one pound of body fat. Once your goal is specific and measurable, it needs to be achievable and attainable. This will help you figure out ways you can realize that goal and work towards it. The achievability of the goal should be stretched to make you feel challenged but defined well enough that you can actually achieve it. Ask yourself:

If you’ve never cooked a day in your life don’t make your goal to make Beef Wellington, start with something attainable like chicken noodle soup, or lasagna. The next part of a goal that helps increase your chances of succeeding is if it is realistic. This means that the goal can be realistically achieved given the available resources and time. A SMART goal is likely realistic if you believe that it can be accomplished. Ask yourself:

Last, but not least, make sure your goal is timely in that it has a start and finish date. If the goal is not time-constrained, there will be no sense of urgency and, therefore, less motivation to achieve the goal. Ask yourself:

For example, building on the goal above: On August 1, I will obtain a gym membership at my local community center. In order to be healthier, I will work out four days a week. Every week, I will aim to lose one pound of body fat. By the end of August, I will have realized my goal if I lose four pounds of fat over the course of the month. The last piece of advice I will give is something Jenni, the broker of McKenna Property Management, told me which is to always write down your goals. Make it tangible and put it in writing. Keep yourself responsible by taking it out of your mind and into real life. With all these ingredients you are sure to make a goal or resolution this New Year's that you can follow-through on and complete. |

Author

Margene Sanchez and others Categories

All

|

Associated with Advantage Realty Ltd

Home

|

Services |

LISTINGS FOR RENT |

BLOG/NEWS

|

Contact

|

Margene Sanchez, REALTOR

License# S.0185552 PM.0168610

Proudly powered by Weebly