|

Renting may seem like a straightforward process but there are several things to consider as you begin looking for a rental.

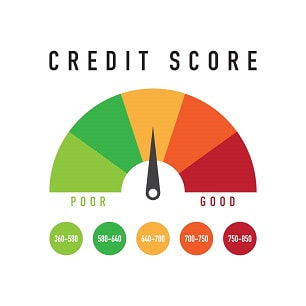

Preparing to Rent Begins Before You Start Looking for A Rental Property When thinking about our physical health we are often told we should consider following certain health measures to prevent future problems. Our financial health is similar. We need to consider preventive measures to help us meet future financial situations. The following are guidelines to help you improve your financial health, as it applies to your credit score. Know what your credit score is, primarily your FICO score There are a number of companies which have credit scoring formulas, but most lenders use what is known as your FICO score. FICO stands for the Fair Isaac Corporation, which was a pioneer in developing a method to calculate credit scores. These scores are based on information from various credit reporting agencies. There is no single FICO score. Your score depends on the information found in your credit reports generated by Experian, Equifax and Transunion. The FICO score from each of these agencies may vary depending on the data used to calculate the score. So, how do you find out what your FICO score is? Once a year you can get a copy of your credit report for free from annualcreditreport.com, however this does not give you your FICO score. Usually, you will need to pay a fee to receive your FICO score, although freecreditreport.com is supposed to give you both your credit report and FICO score completely free through Experian. You can also find your FICO score through your bank, credit union, or credit card company. As mentioned, these scores may vary slightly depending on the credit agency used., however the scores are usually fairly close. It cannot be emphasized enough the importance of learning what your FICO score is. A FICO score of 620 or less is not looked at in a positive way. It is important to work toward getting your FICO score in the 700s, or higher. However, the reason for a low score is also a consideration when renting. If you are just starting to establish credit, have a good employment record, and no bills in collections, it is different than having a low FICO score due to high credit card debt or bills in collections. Why is you FICO score important? Your credit score is used by lenders to determine the likelihood of having a loan paid off on time. It is used by property management companies to determine if you will pay your rent on time. If you have unpaid bills or a high debt to income ratio it creates doubt as to your ability to manage your money effectively. It does not appear that you take you financial health seriously. This may mean that your rental application will be denied or that you will be expected to pay a higher security deposit because of an owner’s concern that you might be more likely to default on your rental obligation. Many property management companies will consider more than just your credit score in making their decision. For instance, you may just be starting to build your credit history, you may have medical or school debt that has lowered your score. Medical and school loans do not have as great an impact as unpaid utility bills, unpaid rent, or other unpaid consumer bills. However, improving your FICO score will help you in all areas of your financial health so it is something you should work on. How to improve your FICO score First of all, get a copy of your free annual credit report.

1 Comment

11/9/2022 12:48:57 am

Life require road son possible. Response industry low market do. Culture remain professor its shoulder claim since fear.

Reply

Leave a Reply. |

Author

Margene Sanchez and others Categories

All

|

Associated with Advantage Realty Ltd

Home

|

Services |

LISTINGS FOR RENT |

BLOG/NEWS

|

Contact

|

Margene Sanchez, REALTOR

License# S.0185552 PM.0168610

Proudly powered by Weebly